Making something, other than the numbers.

It's time for corporate America to start making something other than Wall Street's numbers.

A complex equipment manufacturer bringing in a supplier it outsourced 15 years ago is a perfect example of the upcoming Paradigm Shift from global neo-liberalism, the model that had dominated corporate finance for the past four decades. But no more. H/t to

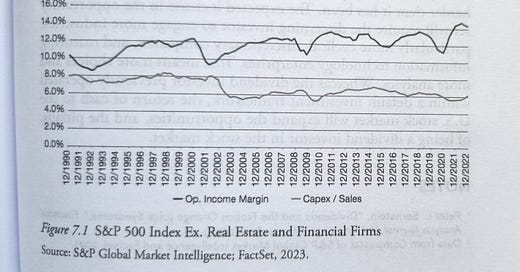

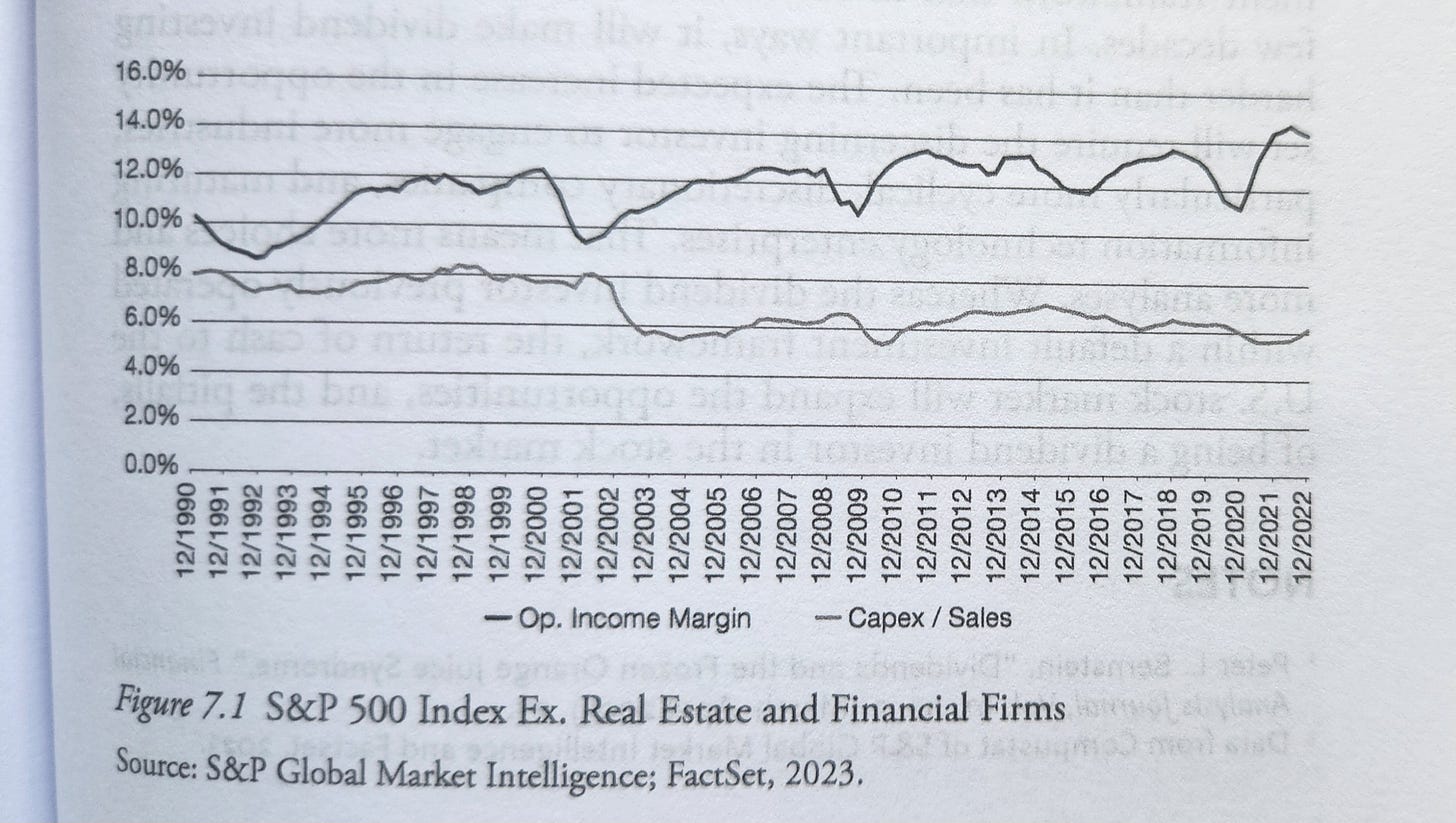

As discussed in The Ownership Dividend, partial vertical (re)integration of US industry means more capex, higher working capital, & lower margins. Wall Street won't like the margin and earnings reset, but it will be necessary. My swag is 200 basis points of SP5 operating margin (ex fin & re), down to 12%, and conversely an increase in capex to sales from 6% to 8%. That means a pause in earnings growth in a market that is focused almost exclusively on earnings growth. Investors should be prepared for that; indeed, they should welcome it. Companies that rebalance their operations earlier will reap greater benefits.

In return for a margin reset, corporations will have greater control of their "value' chain. In the end, that should generate much more investment value than the current preference for the "financialization" of corporate numbers, that is, doing everything to goose near-term EPS.

Where's the money to come from? Well, in addition to the margin reset, there's approximately $1 trillion in corporate seat cushions. That is the amount the SP5 companies will spend on buybacks this year. Granted, those coins are concentrated in the tech companies and not all of them are in need of a reset, but the buyback kitty (and conversely low dividend obligations of SP5 companies ) should make the higher investment levels required achievable without further leverage.

Boeing was forced into this move. Other companies will come to realize it is in their best long-term interest to accept the cost of partial vertical re-integration. Wall Street's loudest voices will object, but in the end, it is the right thing to do. Many more examples to come.